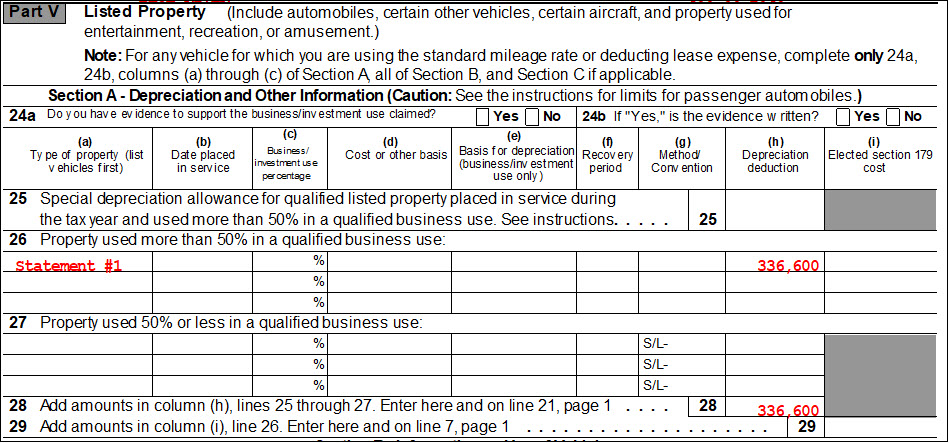

2024 Section 179 Vehicle List Template – Section 179 has been referred to as the “SUV tax loophole” or “Hummer deduction” because it was often used to write off the purchase of qualifying vehicles. The positive impact of Section . What Makes a Vehicle Expensive to Insure? What you pay for car insurance is partially based on the vehicle you’re insuring. This factors in claims that have been paid for similar models. .

2024 Section 179 Vehicle List Template

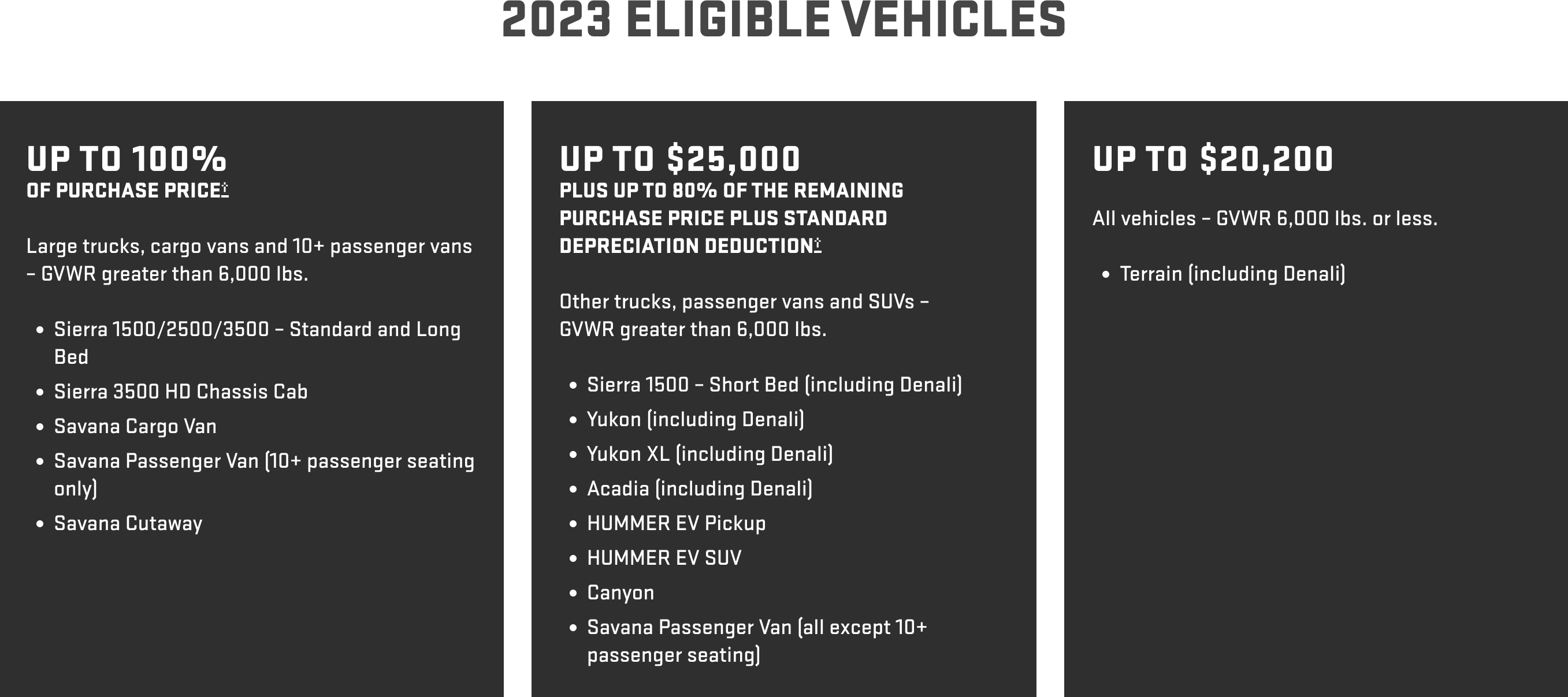

Source : www.commercialcreditgroup.comUnderstanding The Section 179 Deduction Coffman GMC

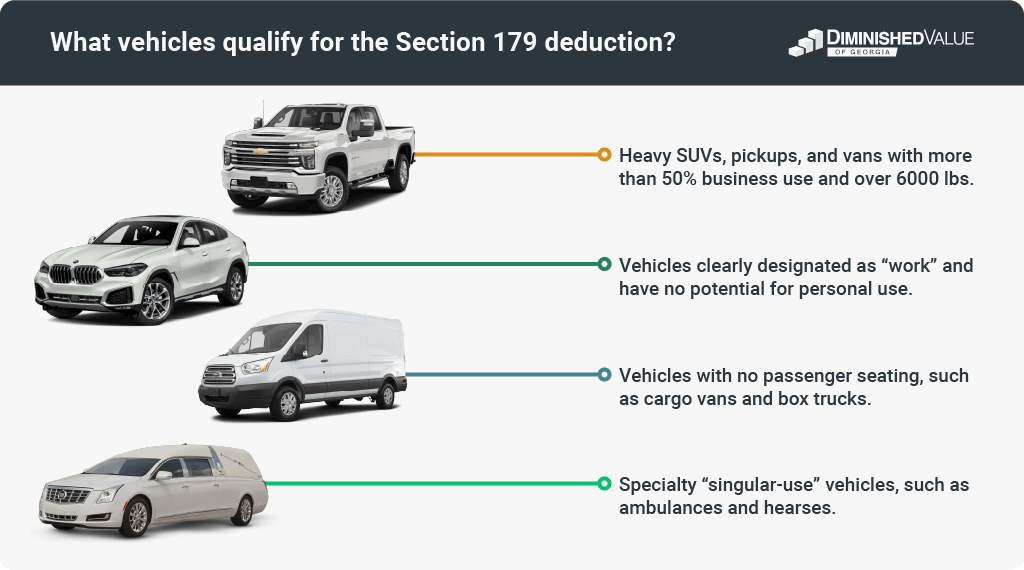

Source : www.coffmangmc.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comSection 179 Deduction – Section179.Org

Source : www.section179.orgSection 179: Definition, How It Works, and Example

Source : www.investopedia.comBEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : m.youtube.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.com4562 Listed Property Type (4562)

Source : drakesoftware.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.com2024 Section 179 Vehicle List Template Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions: Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when . (1.4.1) Vehicles, including mopeds, motorized skateboards/scooters, motorcycles and electric vehicles may only be operated on roadways and in parking lots. **Electric Carts may operate on the verified .

]]>

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)